Days Inventory Outstanding (DIO) is the ultimate measure of inventory efficiency, revealing how long it takes for stock to turn into sales. This key metric provides critical insights into how well a business aligns its inventory levels with actual demand. A low DIO indicates swift stock movement, boosting cash flow by minimising the time capital is tied up in inventory. On the other hand, a high DIO suggests inefficiencies in forecasting, turnover, or purchasing, potentially stalling profitability and straining resources.

What is Days Inventory Outstanding (DIO)?

DIO measures the average number of days it takes for a company to convert its inventory into sales. It acts as a vital performance indicator, showcasing how efficiently a business manages its stock. A lower DIO reflects quick inventory turnover, which is ideal for cash flow and operational agility. Conversely, a higher DIO signals inventory is lingering too long, hinting at possible misalignments in demand forecasting, product turnover, or purchasing strategies.

Striking the right balance is crucial—slow-moving inventory ties up capital, while overly rapid turnover risks stockouts and missed opportunities. DIO isn’t just a metric; it’s a strategic tool for optimising processes, enhancing profitability, and maintaining a resilient, growth-oriented business model.

Demand Planning has undergone significant changes due to the advancement of technologies and contemporary strategies. Adapt with the right resources.

Days Inventory Outstanding Formula

The formula for Days Inventory Outstanding (DIO) is straightforward:

DIO = (Average Inventory / Cost of Goods Sold) × 365

- Average Inventory gives a balanced snapshot of stock levels, calculated by averaging inventory at the start and end of a period.

- Cost of Goods Sold (COGS) includes direct costs like materials and labour tied to production, excluding indirect expenses like distribution.

Multiplying this ratio by 365 translates inventory turnover into days, revealing how long stock stays before being sold. Context matters—industries with fast turnover (e.g., retail) aim for low DIO, while luxury or manufacturing sectors tolerate higher DIO due to longer cycles.

Days Inventory Outstanding Calculation

Let’s break it down with an example:

- Average Inventory: $500,000

- COGS: $2,000,000

Using the formula:

DIO = (500,000 / 2,000,000) × 365 = 91.25 days

This means inventory takes around 91 days to sell. Such insights guide businesses in refining inventory management, balancing cash flow, and aligning operations with industry standards. Streamlining this process with tools like DIO calculators or management software can further enhance efficiency.

What is a Good Days Inventory Outstanding?

A “good” DIO depends on your industry:

- Low DIO: Ideal for fast-moving sectors like retail or food, where inventory under 30 days reflects agile turnover and minimised waste.

- High DIO: Acceptable for industries like manufacturing or luxury goods, where longer cycles and higher costs demand patience—120 days or more may be standard.

While a lower DIO signals efficiency, it’s not always better. Extremely low DIO could mean understocking and missed sales, while high DIO might indicate overstocking or weak demand. The sweet spot lies in balancing turnover with customer needs, ensuring stock moves efficiently without straining cash flow.

Want to gain key implementations for selling more while reducing overstock? You’ve come to the right place.

Days Inventory Outstanding vs. Inventory Turnover

Days Inventory Outstanding (DIO) and Inventory Turnover both illuminate inventory efficiency, yet they focus on different dimensions. DIO tracks how many days stock sits before it’s sold, offering a time-based perspective. In contrast, Inventory Turnover measures how often inventory is sold and replenished within a set period, expressed as a ratio.

For example, high turnover usually pairs with low DIO, signalling swift-moving stock and efficient management. Conversely, low turnover and high DIO hint at slower movement, suggesting overstocking or inefficiencies.

Used together, these metrics provide a holistic view of inventory performance. DIO captures the timeline, while Inventory Turnover quantifies frequency. Together, they empower businesses to balance stock levels, improve cash flow, and enhance profitability through data-driven decisions.

Days Inventory Outstanding and the Cash Conversion Cycle (CCC)

DIO is a cornerstone of the Cash Conversion Cycle (CCC), which calculates the time it takes to transform inventory investment into cash:

CCC = DIO + Days Sales Outstanding (DSO) – Days Payable Outstanding (DPO)

- DIO reflects how long inventory is held.

- DSO measures the time to collect customer payments.

- DPO indicates the time taken to pay suppliers.

A high DIO stretches the CCC, tying up cash in inventory and slowing liquidity. A lower DIO shortens the cycle, speeding cash flow and reducing working capital needs.

Managing DIO within the CCC framework ensures inventory processes align with financial goals. Efficient CCC management enhances cash flow, enabling faster reinvestment into growth opportunities and reducing financial strain.

Importance of Days Inventory Outstanding

DIO is more than a metric; it’s a measure of financial and operational health. Maintaining an optimal DIO minimizes holding costs, reduces waste, and frees cash for reinvestment.

An excessively high DIO ties up capital in stagnant stock, inflating storage and depreciation costs. Conversely, a too-low DIO risks stockouts, missed sales, and dissatisfied customers.

Optimising DIO fosters a lean, agile inventory system that supports profitability, improves cash flow, and aligns inventory processes with business objectives. Mastering DIO is essential for any company seeking to balance efficiency with growth.

Strategies for Improving Days Inventory Outstanding

Optimising Days Inventory Outstanding (DIO) demands a strategic approach to inventory management and a focus on aligning stock levels with customer demand. Here are key strategies for improvement:

- Streamline Procurement Processes: Reduce lead times to ensure inventory arrives when needed, cutting down on storage time.

- Adopt Just-in-Time (JIT) Systems: Stock inventory only as required to meet immediate demand, minimising excess.

- Enhance Demand Forecasting: Use advanced tools to accurately predict customer needs and avoid overstocking.

- Improve Inventory Visibility: Real-time tracking identifies slow-moving items early and prevents unnecessary purchasing.

- Utilise Promotions and Discounts: Accelerate sales of slow-moving stock with targeted offers, freeing up space for high-demand products.

- Optimise Supply Chain Management: Efficient systems help maintain optimal inventory levels and reduce lead times.

Implementing these strategies reduces DIO, improves cash flow, and creates a leaner, more responsive business model ready to adapt to market changes.

Streamline the Procurement Process with AI for an integrated and sustainable supply chain.

Example of Days Inventory Outstanding Calculation

To see DIO in action, consider ABC Electronics:

- Average Inventory: $750,000

- Cost of Goods Sold (COGS): $3,000,000

Using the formula:

DIO = (Average Inventory / COGS) × 365

Step 1: DIO = (750,000 / 3,000,000) × 365

Step 2: DIO = 0.25 × 365 = 91.25 days

This means ABC Electronics takes an average of 91 days to sell its inventory, offering insights into operational efficiency and opportunities for improvement.

Income Statement Assumptions

Accurate Days Inventory Outstanding (DIO) calculations hinge on specific assumptions drawn from the income statement. Sales revenue is essential for understanding the total volume of goods moving through the business, while the cost of goods sold (COGS) reflects the direct expenses involved in producing those goods. Average inventory, calculated by averaging the opening and closing inventory values for the period, offers a balanced perspective that smooths out fluctuations in stock levels. These elements together form the foundation for precise DIO analysis, ensuring calculations are both meaningful and actionable.

Inventory Turnover Ratio Calculation

The Inventory Turnover Ratio complements DIO by highlighting how frequently inventory is sold and replenished. For ABC Electronics:

Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory

= 3,000,000 / 750,000 = 4

This means ABC Electronics cycles through its inventory four times annually. When paired with DIO, this ratio provides a holistic view of inventory efficiency, capturing both the frequency and duration of stock movement.

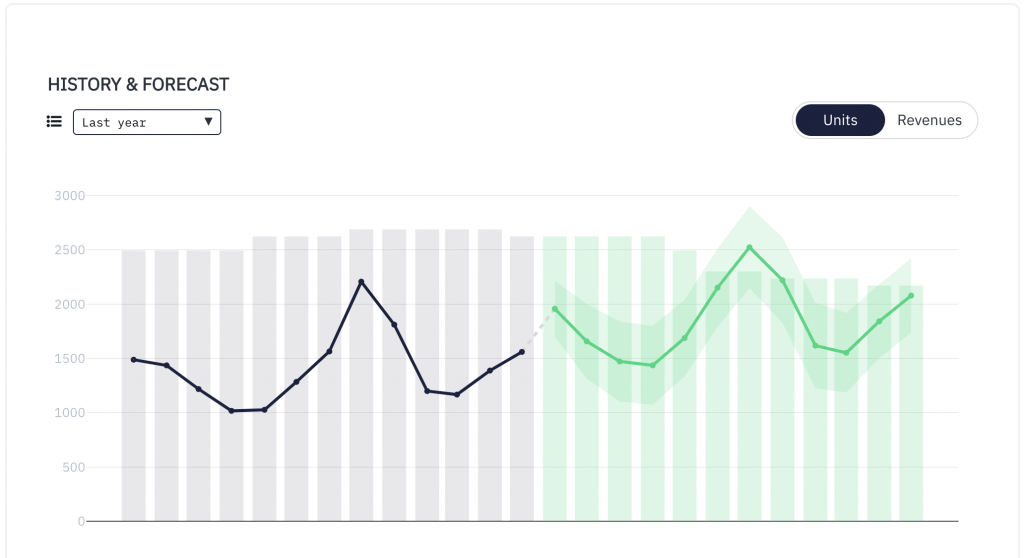

Ending Inventory Balance Forecast

Forecasting the Ending Inventory Balance helps businesses predict DIO trends and adapt to changes in demand. Seasonal fluctuations or product life cycles can significantly impact inventory levels, affecting cash flow and operational efficiency. By forecasting inventory, companies can better align stock levels with upcoming sales trends, ensuring DIO remains optimised and consistent with financial and operational objectives. This proactive approach supports smoother inventory management and sustained business performance.

Tools and Resources for Calculating DIO

Mastering Days Inventory Outstanding (DIO) is easier with the right tools at your fingertips. From simple spreadsheets to advanced software, businesses can choose solutions that match their complexity and needs:

- Excel Spreadsheets: A versatile, accessible option for calculating DIO and related metrics with predefined formulas.

- Online DIO Calculators: Quick and user-friendly, these free tools are ideal for small businesses or those just starting with DIO analysis.

- Integrated Business Management Software: Platforms like SAP, Oracle, or Intuendi offer advanced inventory management and demand forecasting capabilities, perfect for complex operations.

- Demand Forecasting Software: Tools such as Intuendi combine demand forecasting with inventory optimisation, delivering actionable insights to refine DIO and drive profitability.

From basic to sophisticated, these resources empower businesses to monitor and optimise inventory performance. Tools like Intuendi go a step further by integrating forecasting and analysis, enabling smarter, data-driven decisions to align DIO with operational and financial goals.

Is the above information music to your ears? There’s a lot more where that came from. Join Intuendi for a forward-thinking and disruptive approach to inventory management.